Logistea’s growth is based on acquisitions, investments in existing assets and development of brand new facilities in partnership with existing and new tenants. Sustainability is always central to our growth, which is made possible by a strong financial position thanks to stable cash flows generated by long-term, reliable tenants.

Logistea operates in a growing niche where the demand for efficient warehouse and logistics management is increasing with the transformation of retail.

A long-term North European portfolio in attractive locations

Strong financial position

With financially strong owners, solid finances and stable revenue streams, Logistea can realise a strategy for growth that paves the way to long-term sustain able value. The major acquisition of KMC Properties has, on completion of the merger, lent us a critical mass that further underpins this argument.

Diversified and long-term customer base

Logistea’s tenants are financially stable businesses operating across a wide range of sectors and industries, which reduces our risks of rental losses and vacancies. Low vacancies and long leases consisting above all of triple net leases with full CPI adjustment deliver predictably steady cash flows over time.

Ability to do good business

Logistea’s efficient and right-sized organisation makes an experienced team, with an extensive transactional background, that identifies good property deals and development opportunities without losing focus on active management. We deliver on our strategy to create value through acquisitions.

The fact that we doubled our property portfolio during the year in no way means that we feel we have done enough – we are committed to continue growing in our segment. As before, the focus remains on developing and acquiring properties that are let to financially well-established tenants wishing to expand and develop the premises in partnership with us, the property owners. Our growth will continue to advance on several fronts, with acquisitions of individual properties and portfolios, a high pace of investment in our existing portfolio and evaluation of new possible mergers.

Our properties

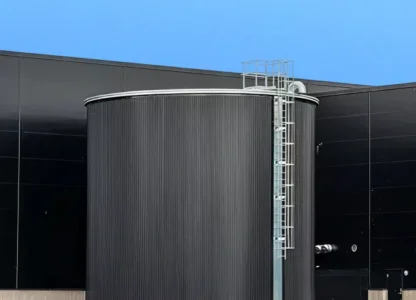

Bulten 1

Alingsås, Sverige